A policy rider in Congress would mean the end of TSP’s mutual fund window

Out of all the updates to the Thrift Savings Plan last June, and the massive pushback from participants that came along with them, there’s one change that has had perhaps a little less time in the spotlight.

Along with rolling over to a new recordkeeper, updating the My Account platform, launching a TSP mobile app and much more last summer, participants also saw a massive uptick in their investment options with the launch of the TSP mutual fund window.

The TSP’s entirely voluntary investment window contains about 5,000 different mutual fund choices for participants. The initial idea was pretty straightforward: give participants more diverse and specialized investment options, without complicating the TSP’s basic structure. Congress first authorized the Federal Retirement Thrift Investment Board to create a mutual fund window back in 2009, and the board finally launched it in June 2022.

But now, just over a year in, a policy rider in legislation from the House Appropriations Committee threatens an early demise of the mutual fund window. The Republican-led committee folded language similar to the “No ESG in the TSP Act,” first introduced in May, into the fiscal 2024 Financial Services and General Government bill.

The language in that appropriations bill currently prohibits funds from going toward any TSP mutual fund options that are based primarily on environmental, social or governance (ESG) criteria. Rep. Chip Roy (R-Texas), who initially introduced the legislation, said the goal is to prevent taxpayer dollars from ending up in “woke” funds.

There will be a ripple effect, though, if the policy rider goes through: FRTIB officials said they would be forced to close the mutual fund window. Keeping track of 5,000 mutual funds would become too burdensome, and open the FRTIB to potential legal exposure. The board has publicly opposed the legislation.

“There is no practical, cost-efficient way to monitor each of the roughly 5,000 individual mutual funds’ holdings,” FRTIB Director of External Affairs Kim Weaver said.

Closing the window would come with a price tag, too.

“If the TSP has to discontinue the mutual fund window, the TSP will have to pay additional money to unwind it,” Weaver said. “In addition, participants who have invested in the mutual fund window could lose money in returning their funds back to the core TSP funds.”

The National Active and Retired Federal Employees Association (NARFE) further urged committee leaders to remove the policy rider from the legislation. In fact, the anti-ESG language may not even achieve the desired effect, said NARFE National President William Shackelford.

“TSP participants would not be prevented from investing in ESG funds — they would simply be forced to move their money out of the TSP to do so,” Shackelford said in a letter to House and Senate Appropriations leaders earlier this month. “It would also force other TSP participants interested in more diversified investments to move their money out as well, because the mutual fund window would cease to exist to provide those options. In the end, it would do more to impose costs on the TSP and its participants than limit ESG investments.”

NARFE Vice President for Policy and Programs John Hatton added that the mutual fund window is a “win-win” for the TSP.

“It’s easier for the participant who wants more options, and it keeps average administrative costs down for all due to less withdrawals from the TSP,” he said.

And while the mutual fund window may more directly benefit current employees looking to diversify their options, Hatton said there’s also an indirect benefit for retirees, since the window can help reduce transfers out of the TSP and keep average administrative fees lower.

But what do participants say about the mutual fund window?

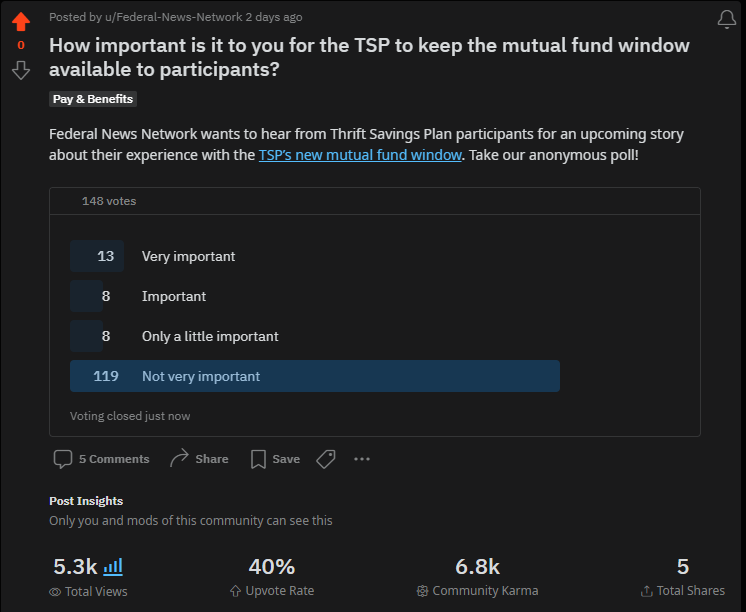

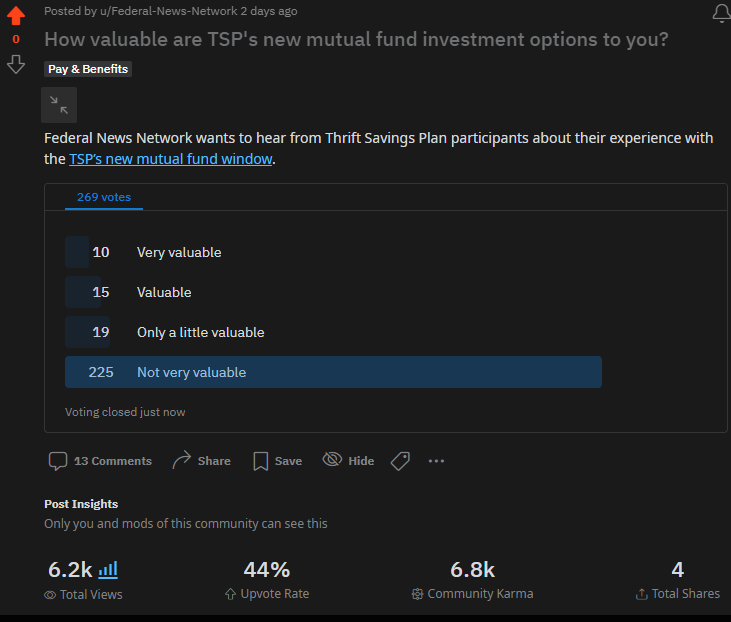

Federal News Network conducted a series of social media polls last week to hear more from participants about their perspective on the mutual fund window. The two poll questions received roughly 500 total votes across FNN’s Facebook, LinkedIn, Instagram and Reddit pages.

More than 80% of voters on Reddit — the platform that received the highest number of votes — said it was “not very important” to them for TSP to keep the mutual fund window open. And close to 84% said the new mutual fund window was “not very valuable.” Albeit with fewer responses, the polls on Facebook, LinkedIn and Instagram all received similar results.

The biggest hang-up for participants? The associated fees.

To participate in the mutual fund window, investors have to make an initial transfer of at least $ 10,000, but no more than 25% of their total TSP account. Then there’s a $ 55 annual administrative fee, a $ 95 annual maintenance fee and a $ 28.75 per-trade fee, along with other fees and expenses specific to the selected mutual funds. The purpose of the fees is to keep the average administrative costs down for TSP participants more broadly.

Still, it’s a high enough cost to deter some participants from opening an account in the window at all.

“I always wanted more investment options, but with those fees, I’m not even sure if it makes sense to go outside of the C fund,” one Reddit user wrote.

“If I was an extremely active and clairvoyant investor and wanted to move funds from one specific thing to the next knowing I’d be making bank, then I’d consider it, but those annual $ 150 fees … are off-putting, to say the least,” another Reddit user wrote.

Still, another poll respondent felt that the negative perspective on the mutual fund window’s fees wasn’t all that warranted.

“I like the mutual fund window because it provides another way to diversify one’s investments — within in a tax-advantaged environment,” the anonymous federal employee said in email. “I am aware of the fees required by the mutual fund window, but believe that if used correctly, it can be a vehicle to increase investment diversity and broaden one’s allocation, if one doesn’t trade after buying the shares.”

A little more than a year after its launch, just 3,600 of the 6.8 million TSP participants have so far transferred funds into the mutual fund window, reaching a combined total of $ 211.5 million invested. In total, the TSP has roughly $ 750 billion in assets under management.